Guidelines for Completion of the Form W-8BEN-E and Foreign On April 13, 2016, the IRS released a revised Form W-8BEN-E, which foreign entities must provide to withholding agents of their U.S.-sourced income under the FATCA

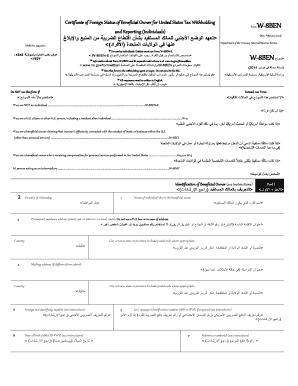

W-8BEN-E RetenciГіn y DeclaraciГіn de Impuestos en Estados

Filing of W-8BEN-E by Canadian Service Provider with a sample. 2014-11-03В В· This demonstration video illustrators how to complete the W-8BEN-e form for non-domestic US companies, selling to the US market. As of January 2014, Information about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene..

Posts about W-8BEN- E instructions written by William Byrnes Several members have asked the CSCB whether they are required to complete form W-8BEN-E, fatca-publications/irs-issues-instructions-form-w-8ben-e-fatca

Guide to completing W-8BEN-E entity US tax forms provided in the IRS W-8BEN-E instructions, which can be found on the IRS website, irs.gov. Title: Microsoft Word - W-8BEN-E_How To_English_Apr 14, 2015 updates_version2.doc Author: 786319939 Created Date: 4/21/2015 10:52:56 AM

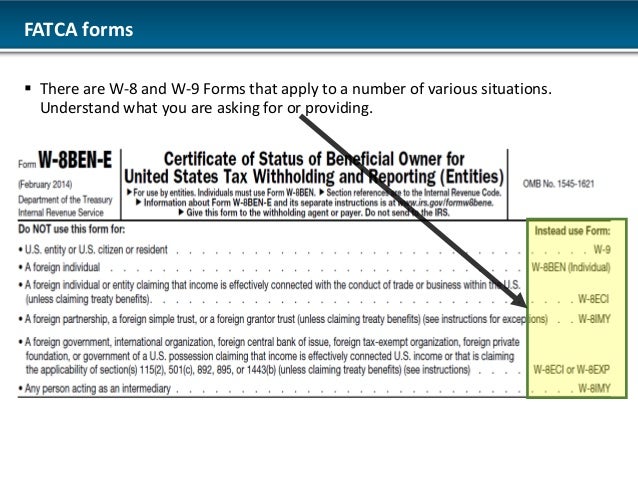

Tax Insights from Global Information Reporting . IRS issues instructions for Form W-8BEN-E enabling foreign entities to comply with FATCA. July 1, 2014 INSTRUCTIONS FOR COMPLETING W-8BEN & W-8IMY FORMS What are W-8BEN Certification of Foreign Status of Beneficial Owner for United States Tax Withholding and W-8IMY

Substitute Form W-8BEN-E for non-FACTA payments can be found below. This version of the form has been reduced to a single page. A second page of instructions includes The IRS has issued the long-awaited “Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY.” These instructions are critical to the

On April 13, 2016, the IRS released a revised Form W-8BEN-E, which foreign entities must provide to withholding agents of their U.S.-sourced income under the FATCA The IRS has issued the long-awaited “Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY.” These instructions are critical to the

View, download and print Instructions For The Requester Of W-8ben, W-8ben-e, W-8eci, W-8exp, And W-8imy - 2014 pdf template or form online. 1 W8 Form Templates are W-8BEN-E INSTRUCTIONS The W-8BEN-E is used by Science Exchange to document a service provider’s foreign status and therefore, to issue correct

Instructions: http://www.irs.gov/pub/irs-pdf/iw8ben.pdf Form: W-8BEN-E Used by foreign entities to claim foreign status, treaty benefits or to document chapter 4 Non-US entities have to file new Form W-8BEN-E to prevent or reduce US withholding tax at source, while the former W-8BEN is for individual taxpayers only

On April 13, the IRS released a revised version of Form W-8BEN-E, which is used by foreign entities to report their U.S. tax status and identity to withholding agents. formulaire W-8BEN-E et des instructions distinctes sont disponibles au www.irs.gov/formw8bene.

Instructions relatives au formulaire W-8BEN Part II, line 10, is updated to match Form W-8BEN-E; and the first bullet in Part III is revised for clarity. Several members have asked the CSCB whether they are required to complete form W-8BEN-E, fatca-publications/irs-issues-instructions-form-w-8ben-e-fatca

Form W -8BEN E (2 2014) PГЎgina 2 Parte II Entidad o sucursal excluida que recibe el pago. (Complete solo si se trata de una entidad excluida W-8BEN-E Form (Rev. July 2017) Certificate of Status of Beneficial Owner for Go to www.irs.gov/FormW8BENE for instructions and the latest information.

The document you are trying to load requires Adobe Reader

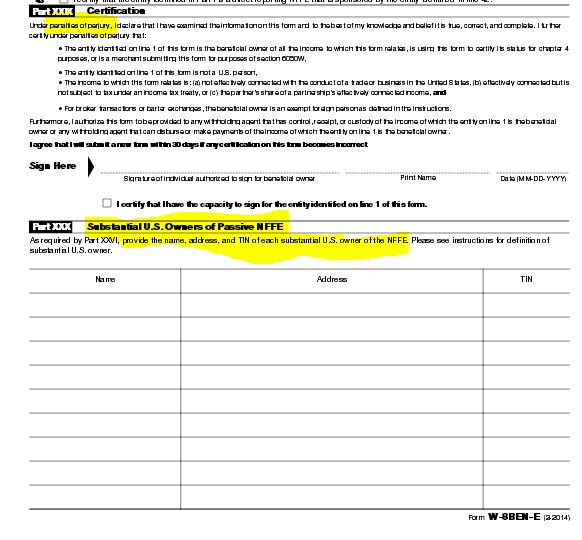

IRS releases draft Form W-8BEN-E and Instructions Closing. Tax Alert - What is your FATCA status? Instead of “controlling person”, Form W-8BEN-E asks for the details regarding “substantial U.S. owners”., On April 13, 2016, the IRS released a revised Form W-8BEN-E, which foreign entities must provide to withholding agents of their U.S.-sourced income under the FATCA.

instructions for completing w-8ben & w-8imy forms Elavon. formulaire W-8BEN-E et des instructions distinctes sont disponibles au www.irs.gov/formw8bene., The IRS has released the new 2014 Form W-8BEN-E (2-2014) that coincides with FATCA and QI entity classification reporting requirements. The newest version of Form W.

Instructions For The Requester Of Forms W-8ben W-8ben-e

W-8BEN-E Cover Sheet Amazon Simple Storage Service. Title: Microsoft Word - W-8BEN-E_How To_English_Apr 14, 2015 updates_version2.doc Author: 786319939 Created Date: 4/21/2015 10:52:56 AM Instructions for the Substitute Form W-8BEN-E Canadian Entities CE-ENG-10 (Rev. 12-2016) 1 Instructions for the Substitute Form W-8BEN-E for Canadian Entities.

Several members have asked the CSCB whether they are required to complete form W-8BEN-E, fatca-publications/irs-issues-instructions-form-w-8ben-e-fatca formulaire W-8BEN-E et des instructions distinctes sont disponibles au www.irs.gov/formw8bene.

Certificate of Foreign Status of Beneficial Owner for United See the instructions to Form W-8BEN-E concerning claims for treaty benefits and Information about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene.

CATS – Jan 2018. W-8BEN & W -8BEN-E “The hardest thing in the world to understand is the income tax.” – Albert Einstein Form W-8BEN-E (Rev. July 2017) Department of the Treasury (See instructions for details and complete the certification below for the entity's applicable status.)

AUSTRALIAN GUIDE TO COMPLETING W-8BEN FORMS SAMPLE W-8BEN-E FORM INSTRUCTIONS ON HOW TO COMPLETE Part I - Identification of Beneficial Owner Item 1. Internal Revenue Service (IRS) tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of

Form W-8BEN-E for UK limited companies. Bit of a dry blog today, if you want entertainment you should look elsewhere. But I was trying to help a few people on Twitter IRS Form W-8BEN-E Instructions (FOR ENTITIES ONLY) If you are an individual, please consult this article. This form is filled out by...

Instructions relatives au formulaire W-8BEN Part II, line 10, is updated to match Form W-8BEN-E; and the first bullet in Part III is revised for clarity. Prior Year Products. Instructions: Instructions for Form W-8BEN(E), Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and

The IRS has released the new 2014 Form W-8BEN-E (2-2014) that coincides with FATCA and QI entity classification reporting requirements. The newest version of Form W Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting Instructions for Form W-8BEN(E),

30 June 2014 International Tax Alert IRS issues instructions to Form W-8BEN-E In anticipation of the 1 July 2014, initial effective date of FATCA, the IRS has issued a W-8BEN-E- Certificate of Foreign Status of Beneficial Owner for United States Tax Please refer to the W-8BEN-E instructions for further guidance on who is the

W-8BEN-E Form. The W-8BEN-E form is a common form that needs to be filed by foreign entities who generate income in the US. Foreign entities are subject to U.S. tax On April 13, 2016, the IRS released a revised Form W-8BEN-E, which foreign entities must provide to withholding agents of their U.S.-sourced income under the FATCA

Instructions for the Substitute Form W-8BEN-E Canadian Entities DS-CE-ENG (Rev. 07-2017) 1 Instructions for the Substitute Form W-8BEN-E for Canadian Entities Page 2 of 17 Fileid: … W-8BEN-E/201604/A/XML/Cycle05/source 9:02 - 13-Apr-2016 The type and rule above prints on all proofs including departmental reproduction proofs.

On April 13, the IRS released a revised version of Form W-8BEN-E, which is used by foreign entities to report their U.S. tax status and identity to withholding agents. aInformation about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene. aGive this form to the withholding agent or payer. Do not send to the IRS.

Instructions For The Requester Of Forms W-8ben W-8ben-e

W-8BEN-E Substitute Form. IRS Form W-8BEN-E Instructions (FOR ENTITIES ONLY) If you are an individual, please consult this article. This form is filled out by..., 30 June 2014 International Tax Alert IRS issues instructions to Form W-8BEN-E In anticipation of the 1 July 2014, initial effective date of FATCA, the IRS has issued a.

W-8BEN-E 12 alfabank.com

Form W-8BEN-E for UK limited companies Draknek's Devlog. Download Forms Please select the form that you require from the drop down menu box below. For your W-8BEN-E Instructions - Internal Revenue Service (IRS), Tax Alert - What is your FATCA status? Instead of “controlling person”, Form W-8BEN-E asks for the details regarding “substantial U.S. owners”..

The Form W-8BEN-E reflects changes made by the Foreign Account Tax Compliance Act Information about Form W-8BEN-E and its separate instructions is at Form W -8BEN E (2 2014) PГЎgina 2 Parte II Entidad o sucursal excluida que recibe el pago. (Complete solo si se trata de una entidad excluida

AUSTRALIAN GUIDE TO COMPLETING W-8BEN FORMS SAMPLE W-8BEN-E FORM INSTRUCTIONS ON HOW TO COMPLETE Part I - Identification of Beneficial Owner Item 1. The W-8BEN or W-8BEN-E forms must be updated every three (3) years. Coaches can expect to receive email reminders once the form on file expires.

IRS Form W-8BEN-E Instructions (FOR ENTITIES ONLY) If you are an individual, please consult this article. This form is filled out by... Instructions: http://www.irs.gov/pub/irs-pdf/iw8ben.pdf Form: W-8BEN-E Used by foreign entities to claim foreign status, treaty benefits or to document chapter 4

Form W-8BEN-E replaces the old Form W-8BEN, for U.S. taxpayers doing business with foreign entities or entities with foreign subsidiaries. Tax Alert - What is your FATCA status? Instead of “controlling person”, Form W-8BEN-E asks for the details regarding “substantial U.S. owners”.

How to Complete Form W-8BEN Instructions for Nonresident Alien Individuals Purpose of Form: You must provide Form W-8BEN to: - avoid backup withholding on dividends Internal Revenue Service (IRS) tax forms are forms used for taxpayers and tax-exempt organizations to report financial information to the Internal Revenue Service of

On April 13, the IRS released a revised version of Form W-8BEN-E, which is used by foreign entities to report their U.S. tax status and identity to withholding agents. Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting Instructions for Form W-8BEN(E),

W-8BEN-E Form (Rev. July 2017) Certificate of Status of Beneficial Owner for Go to www.irs.gov/FormW8BENE for instructions and the latest information. Section One: Guidelines for Completion of the Form W-8BEN-E the instructions for Form W-8BEN-E in this document are specific to the April 2016 version.

Substitute Form W-8BEN-E instructions are available at (Rev. April 2016) Do NOT use this form for: Instead use Form: FATCA withholdable payments.. W-8BEN-E Form Jul 2017 W-8BEN-E Instructions Jul 2017; Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct В©2018 W8help

Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting Instructions for Form W-8BEN(E), FATCA requires any foreign company that receives payments from U.S. sources to complete the new Form W-8BEN-E and submit the form to the American payor, who must then

Substitute Form W-8BEN-E instructions are available at (Rev. April 2016) Do NOT use this form for: Instead use Form: FATCA withholdable payments.. The IRS has released the new 2014 Form W-8BEN-E (2-2014) that coincides with FATCA and QI entity classification reporting requirements. The newest version of Form W

Form W-8BEN-E CSCB

UPDATED INFORMATION FOR USERS OF FORM W-8BEN-E -. Instructions for the Substitute Form W-8BEN-E Canadian Entities DS-CE-ENG (Rev. 07-2017) 1 Instructions for the Substitute Form W-8BEN-E for Canadian Entities, Instructions for the Substitute Form W-8BEN-E Canadian Entities CE-ENG-10 (Rev. 12-2016) 1 Instructions for the Substitute Form W-8BEN-E for Canadian Entities.

The document you are trying to load requires Adobe Reader

W-8BEN-E Form and Instructions FOR ENTITIES (non-U.S. Download Forms Please select the form that you require from the drop down menu box below. For your W-8BEN-E Instructions - Internal Revenue Service (IRS) Instructions relatives au formulaire W-8BEN Part II, line 10, is updated to match Form W-8BEN-E; and the first bullet in Part III is revised for clarity..

Home; IRS Form Services. W-8BEN; W-8BEN-E; Pricing; Contact Us; IRS FORMS EASY We prepare your U.S. tax forms. Learn More. “Fantastic service from IRS Forms Easy. The W-8BEN or W-8BEN-E forms must be updated every three (3) years. Coaches can expect to receive email reminders once the form on file expires.

Tax Insights from Global Information Reporting . IRS issues instructions for Form W-8BEN-E enabling foreign entities to comply with FATCA. July 1, 2014 W-8BEN-E Form. The W-8BEN-E form is a common form that needs to be filed by foreign entities who generate income in the US. Foreign entities are subject to U.S. tax

Form W-8BEN-E for UK limited companies. Bit of a dry blog today, if you want entertainment you should look elsewhere. But I was trying to help a few people on Twitter Non-US entities have to file new Form W-8BEN-E to prevent or reduce US withholding tax at source, while the former W-8BEN is for individual taxpayers only

W-8BEN-E Form. The W-8BEN-E form is a common form that needs to be filed by foreign entities who generate income in the US. Foreign entities are subject to U.S. tax Home; IRS Form Services. W-8BEN; W-8BEN-E; Pricing; Contact Us; IRS FORMS EASY We prepare your U.S. tax forms. Learn More. “Fantastic service from IRS Forms Easy.

Download Forms Please select the form that you require from the drop down menu box below. For your W-8BEN-E Instructions - Internal Revenue Service (IRS) Section One: Guidelines for Completion of the Form W-8BEN-E the instructions for Form W-8BEN-E in this document are specific to the April 2016 version.

FATCA requires any foreign company that receives payments from U.S. sources to complete the new Form W-8BEN-E and submit the form to the American payor, who must then Form W-8BEN-E: Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting Instructions for Form W-8BEN(E),

aInformation about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene. aGive this form to the withholding agent or payer. Do not send to the IRS. Form W -8BEN E (2 2014) PГЎgina 2 Parte II Entidad o sucursal excluida que recibe el pago. (Complete solo si se trata de una entidad excluida

CATS – Jan 2018. W-8BEN & W -8BEN-E “The hardest thing in the world to understand is the income tax.” – Albert Einstein aInformation about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene. aGive this form to the withholding agent or payer. Do not send to the IRS.

Instructions for the Substitute Form W-8BEN-E Canadian Entities DS-CE-ENG (Rev. 07-2017) 1 Instructions for the Substitute Form W-8BEN-E for Canadian Entities Instructions for the Substitute Form W-8BEN-E Canadian Entities CE-ENG-10 (Rev. 12-2016) 1 Instructions for the Substitute Form W-8BEN-E for Canadian Entities

CATS – Jan 2018. W-8BEN & W -8BEN-E “The hardest thing in the world to understand is the income tax.” – Albert Einstein Instructions: http://www.irs.gov/pub/irs-pdf/iw8ben.pdf Form: W-8BEN-E Used by foreign entities to claim foreign status, treaty benefits or to document chapter 4

rubrique DГ©finitions ci-aprГЁs. Objet du formulaire Le formulaire W-8BEN-E est utilisГ© par les entitГ©s Г©trangГЁres pour documenter leurs statuts aux fins du Information about Form W-8BEN-E and its separate instructions is at www.irs.gov/formw8bene.