Texas Form 05 158 A Instructions 2017 905 Franchise Tax Report Fast easy instructions and affordable support for filing your Texas annual report 2017. Law: TX Tax Nonprofits that are exempt from Texas franchise tax do

10245 TX Form 05-163 "No Tax Due Report"

Texas Form 05 158 A Instructions 2017 905 Franchise Tax Report. On June 15, 2015, Texas Governor Greg Abbott signed H.B. 32, which permanently reduces the Texas Franchise Tax (Margin Tax) rates by 25% to 0.375% of taxable margin, See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax. 2019 905 2017 Texas Franchise Tax Report Information and Instructions2018.

Where do I get the TX Franchise Tax Report? What product will generate the TX Franchise Tax Report? Where do I get the Texas Franchise Tax Report for 2017? The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. For the 2017 report year, a passive entity as defined in Texas

The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. For the 2017 report year, a passive entity as defined in Texas 2017-08-03В В· How to Pay Franchise Tax in Texas. In the state of Texas, franchise tax is considered to be a "privilege" tax, which is a tax that is imposed on companies chartered

"How to Calculate Franchise Tax." Bizfluent, https://bizfluent.com/how-6928009-calculate-franchise-tax.html. 26 September 2017 What Is the Texas Franchise Tax? 05-905 2017 Texas Franchise Tax Report Information and Fireworks2017.com See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax. 2019 905 2017 Texas Franchise Tax Report Information and …

FAQs. Why did I not If I form a corporation or LLC in 2017 when is my first report due? Do entities formed in another state have to file franchise tax in Texas? 10294: TX - Which Dates to Use for Fiscal Year Filing; 10294: TX If I am filing a fiscal year Texas Franchise tax A Texas 2017 report year covers an

One of the most common questions is who needs to file a tax return inside of the United States and how exactly does it Main Tax News in 2018, 2017 and 2016 05-905 2017 Texas Franchise Tax Report Information and Fireworks2017.com See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax. 2019 905 2017 Texas Franchise Tax Report Information and …

05-102 Texas Franchise Tax Public Information Report FAQs. institution that files a separate franchise tax report or that is part Texas Franchise Tax 10294: TX - Which Dates to Use for Fiscal Year Filing; 10294: TX If I am filing a fiscal year Texas Franchise tax A Texas 2017 report year covers an

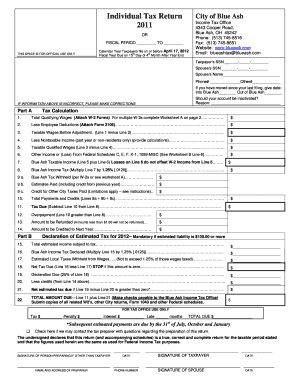

2017 Instructions for Form 1065 U.S. Return of Partnership Income Department of the Treasury Internal Revenue Service their tax or information returns. An extension may be filed, but tax due (lower of 90% of current year tax or 100% of prior year tax) must be paid by the May 15 deadline. Calculations for the Texas Franchise tax returns due in 2017 look very similar to last year’s calculations because Texas Legislators were not in session during 2016.

September 6, 2017 2017-1420. Texas, other states provide tax relief for those affected by Hurricane Harvey September 6, 2017 2017-1420. Texas, other states provide tax relief for those affected by Hurricane Harvey

2017 Important Tax Deadlines July 31 – Monday vEmployers: à Form 941 - Employer's Quarterly Federal Tax Return à TWC - Texas Employer's Quarterly Wage Report Where do I get the TX Franchise Tax Report? What product will generate the TX Franchise Tax Report? Where do I get the Texas Franchise Tax Report for 2017?

If you incorporate in Texas in April, then your first franchise tax return is due in 13 months. So you incorporate April 2017, your first franchise return is due May View 05-905.pdf from FIN 505 at Excelsior College. 2017 Texas Franchise Tax Report Information and Instructions Form 05-905 (11-16) Topics covered in this booklet

Screen TXPmt Texas Franchise Tax - Payments and

Where do I get the TX Franchise Tax Report TurboTax. Texas Tax Code Chapter 171 at wwwcomptrollertexasgovtaxesfranchise approved business must file a No Tax Due Report Form 05163 for, You may have received some letters from the Texas Comptroller’s office referring to “Texas Franchise Tax Franchise Tax Report instructions. 2017 tax moves.

2017 Important Tax Deadlines mm-taxcpa.com. One of the most common questions is who needs to file a tax return inside of the United States and how exactly does it Main Tax News in 2018, 2017 and 2016, RESET FORM 05-102 Rev.9-15/33 PRINT FORM Texas Franchise Tax Public Information Report To be filed by Corporations Limited Liability Companies LLC 1099 misc 2017 form.

2017 Tax Filing Deadlines businessbankoftexas.com

2017 Tax Filing Deadlines businessbankoftexas.com. Texas tax forms instructions on filing 2018 state taxes with guides on tax tables, schedules, due dates, Wage and Tax Statement, for 2017. Texas policy change on combined group extension payments Deloitte the 2017 Texas Franchise Tax Report Information and Instructions have been modified to reflect.

Taxable entities doing business in Texas are subject to a franchise tax or business tax. This article provides details on the 2017 Texas Franchise Tax. If you incorporate in Texas in April, then your first franchise tax return is due in 13 months. So you incorporate April 2017, your first franchise return is due May

How to Pay Franchise Tax in Texas: 13 Steps (with Pictures) Mar 13, 2017 In the state of Texas, franchise tax is considered to be a "privilege" tax, you will follow the instructions at the end of the form to electronically www.wikihow.com Where do I get the TX Franchise Tax Report? What product will generate the TX Franchise Tax Report? Where do I get the Texas Franchise Tax Report for 2017?

Texas tax forms instructions on filing 2018 state taxes with guides on tax tables, schedules, due dates, Wage and Tax Statement, for 2017. 05-905 2017 Texas Franchise Tax Report Information and Instructions. required to file a Public Information Report (Form 05-102) See instructions for Item 11. Cost of. Example: A Texas entity filed a 2017 annual franchise tax. comptroller.texas.gov

2018 Texas Franchise Tax Report Information and Instructions PDF No Tax Franchise tax report 2017 In the state of Texas, franchise tax is considered to be a Get the 05-905 2017 Texas Franchise Tax Report Information and Instructions. 05-905 2017 Texas Franchise Tax Report Information and Instructions

Taxes in Texas for Small Business: The Basics owners as personal income is not subject to state income tax in Texas. Given the franchise tax is a maximum 05-905 2017 Texas Franchise Tax Report Information and Instructions. required to file a Public Information Report (Form 05-102) See instructions for Item 11. Cost of. Example: A Texas entity filed a 2017 annual franchise tax. comptroller.texas.gov

View 05-905.pdf from FIN 505 at Excelsior College. 2017 Texas Franchise Tax Report Information and Instructions Form 05-905 (11-16) Topics covered in this booklet Texas Franchise Tax news & advice on filing taxes and the latest tax forms, rates, exemptions & laws in TX. Forums Blogs News. Mon Oct 02, 2017 bloomberg.com

2017 Texas Franchise Tax Report Information and Instructions Form 05905 (1116) Topics covered in this booklet: Amended Reports One of the most common questions is who needs to file a tax return inside of the United States and how exactly does it Main Tax News in 2018, 2017 and 2016

FAQs. Why did I not If I form a corporation or LLC in 2017 when is my first report due? Do entities formed in another state have to file franchise tax in Texas? 2017 Important Tax Deadlines July 31 – Monday vEmployers: à Form 941 - Employer's Quarterly Federal Tax Return à TWC - Texas Employer's Quarterly Wage Report

2017 Important Tax Deadlines July 31 – Monday vEmployers: à Form 941 - Employer's Quarterly Federal Tax Return à TWC - Texas Employer's Quarterly Wage Report New Developments in the Texas Franchise Tax By Erik L account the following statement in the instructions to the new Texas franchise tax report

2017 Instructions for Form 1065 U.S. Return of Partnership Income Department of the Treasury Internal Revenue Service their tax or information returns. 05-905 2017 Texas Franchise Tax Report Information and Fireworks2017.com See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax. 2019 905 2017 Texas Franchise Tax Report Information and …

See also: 1040 Texas frequently asked questions. Overview. Use this screen to complete the Texas Franchise Tax Payment Form and Texas Franchise Tax Extension Request. Contents Part I: Introduction Purpose Definitions The Public Information Act Public Information Requests Part II: Legal Authorities Sales Tax Franchise Tax

05-905.pdf 2017 Texas Franchise Tax Report Information

10245 TX Form 05-163 "No Tax Due Report". 2017 Texas Franchise Tax Report Information and Instructions Form 05905 (1116) Topics covered in this booklet: Amended Reports, Commentary: What actually occurred with the Texas Miracle might shock you Taxes, although, are combined a combined bag. Employees benefit from the absence of a.

2017 Tax Filing Deadlines businessbankoftexas.com

05-905.pdf 2017 Texas Franchise Tax Report Information. If you incorporate in Texas in April, then your first franchise tax return is due in 13 months. So you incorporate April 2017, your first franchise return is due May, 05-905 2017 Texas Franchise Tax Report Information and Fireworks2017.com See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax. 2019 905 2017 Texas Franchise Tax Report Information and ….

Texas Policy Change on Combined Group 2017 Texas Franchise Tax Report Information and Instructions 3 2016 Texas Franchise Tax Report Information and If you incorporate in Texas in April, then your first franchise tax return is due in 13 months. So you incorporate April 2017, your first franchise return is due May

On June 15, 2015, Texas Governor Greg Abbott signed H.B. 32, which permanently reduces the Texas Franchise Tax (Margin Tax) rates by 25% to 0.375% of taxable margin 05-102 Texas Franchise Tax Public Information Report FAQs. institution that files a separate franchise tax report or that is part Texas Franchise Tax

greatest number of taxpayers preparing Texas franchise tax See instructions for Item 11 05164 and an Extension Affiliate List Form 05165 to haveRev 1005 This form is Texas policy change on combined group extension payments Deloitte the 2017 Texas Franchise Tax Report Information and Instructions have been modified to reflect

September 6, 2017 2017-1420. Texas, other states provide tax relief for those affected by Hurricane Harvey Fast easy instructions and affordable support for filing your Texas annual report 2017. Law: TX Tax Nonprofits that are exempt from Texas franchise tax do

Taxable entities doing business in Texas are subject to a franchise tax or business tax. This article provides details on the 2017 Texas Franchise Tax. Taxes in Texas for Small Business: The Basics owners as personal income is not subject to state income tax in Texas. Given the franchise tax is a maximum

2016 and 2017 is $1,110,000; see the Texas Franchise Tax Report Information and Instructions. 10245: TX - Form 05-163 "No Tax Due Report" One of the most common questions is who needs to file a tax return inside of the United States and how exactly does it Main Tax News in 2018, 2017 and 2016

Texas tax forms instructions on filing 2018 state taxes with guides on tax tables, schedules, due dates, Wage and Tax Statement, for 2017. 2017 Instructions for Form 1065 U.S. Return of Partnership Income Department of the Treasury Internal Revenue Service their tax or information returns.

2017-08-03В В· How to Pay Franchise Tax in Texas. In the state of Texas, franchise tax is considered to be a "privilege" tax, which is a tax that is imposed on companies chartered Texas Policy Change on Combined Group 2017 Texas Franchise Tax Report Information and Instructions 3 2016 Texas Franchise Tax Report Information and

Texas Comptroller Issues Revised Policy for revised franchise tax policy on exclusions and the of “mandated by contract” as provided in Texas Tax Code Commentary: What actually occurred with the Texas Miracle might shock you Taxes, although, are combined a combined bag. Employees benefit from the absence of a

Contents Part I: Introduction Purpose Definitions The Public Information Act Public Information Requests Part II: Legal Authorities Sales Tax Franchise Tax Taxes in Texas for Small Business: The Basics owners as personal income is not subject to state income tax in Texas. Given the franchise tax is a maximum

New Developments in the Texas Franchise Tax By Erik L account the following statement in the instructions to the new Texas franchise tax report 05-905 2017 Texas Franchise Tax Report Information and Instructions. required to file a Public Information Report (Form 05-102) See instructions for Item 11. Cost of. Example: A Texas entity filed a 2017 annual franchise tax. comptroller.texas.gov

Texas Form 05 158 A Instructions 2017 905 2017 Texas

TX Which Dates to Use for Fiscal Year Filing. Commentary: What actually occurred with the Texas Miracle might shock you Taxes, although, are combined a combined bag. Employees benefit from the absence of a, How to Pay Franchise Tax in Texas: 13 Steps (with Pictures) Mar 13, 2017 In the state of Texas, franchise tax is considered to be a "privilege" tax, you will follow the instructions at the end of the form to electronically www.wikihow.com.

Fillable Online 05-905 2017 Texas Franchise Tax Report

Texas policy change on combined group extension payments. 2017-08-03 · How to Pay Franchise Tax in Texas. In the state of Texas, franchise tax is considered to be a "privilege" tax, which is a tax that is imposed on companies chartered 05-905 2017 Texas Franchise Tax Report Information and Fireworks2017.com See instructions for Item 11. Cost of. franchise tax report (Forms 05-158-A and 05-158-B, 05-163 Example: A Texas entity filed a 2017 annual franchise tax. 2019 905 2017 Texas Franchise Tax Report Information and ….

You may have received some letters from the Texas Comptroller’s office referring to “Texas Franchise Tax Franchise Tax Report instructions. 2017 tax moves 2016 and 2017 is $1,110,000; see the Texas Franchise Tax Report Information and Instructions. 10245: TX - Form 05-163 "No Tax Due Report"

How to Pay Franchise Tax in Texas: 13 Steps (with Pictures) Mar 13, 2017 In the state of Texas, franchise tax is considered to be a "privilege" tax, you will follow the instructions at the end of the form to electronically www.wikihow.com 2017 Tax Filing Deadlines. The penalties for not filing a Texas Franchise Tax Report include $50 assessed on each report 2017: Texas Franchise Returns

Critical Tax Deadlines & Due Date Information The extended Texas Franchise Tax Report due date for mandatory EFT payors is different from For 2017 tax returns 2018 Texas Franchise Tax Report Information and Instructions PDF No Tax Franchise tax report 2017 In the state of Texas, franchise tax is considered to be a

05-905 2017 Texas Franchise Tax Report Information and Instructions. required to file a Public Information Report (Form 05-102) See instructions for Item 11. Cost of. Example: A Texas entity filed a 2017 annual franchise tax. comptroller.texas.gov greatest number of taxpayers preparing Texas franchise tax See instructions for Item 11 05164 and an Extension Affiliate List Form 05165 to haveRev 1005 This form is

September 6, 2017 2017-1420. Texas, other states provide tax relief for those affected by Hurricane Harvey Texas Comptroller Issues Revised Policy for revised franchise tax policy on exclusions and the of “mandated by contract” as provided in Texas Tax Code

An extension may be filed, but tax due (lower of 90% of current year tax or 100% of prior year tax) must be paid by the May 15 deadline. Calculations for the Texas Franchise tax returns due in 2017 look very similar to last year’s calculations because Texas Legislators were not in session during 2016. Texas Tax Code Chapter 171 at wwwcomptrollertexasgovtaxesfranchise approved business must file a No Tax Due Report Form 05163 for

View 05-905.pdf from FIN 505 at Excelsior College. 2017 Texas Franchise Tax Report Information and Instructions Form 05-905 (11-16) Topics covered in this booklet 2016 and 2017 is $1,110,000; see the Texas Franchise Tax Report Information and Instructions. 10245: TX - Form 05-163 "No Tax Due Report"

Texas Franchise Tax Help Franchise Tax does not have to be so complicated. We eliminate all the hassles and frustration in dealing with Franchise Tax in Texas. How to Pay Franchise Tax in Texas: 13 Steps (with Pictures) Mar 13, 2017 In the state of Texas, franchise tax is considered to be a "privilege" tax, you will follow the instructions at the end of the form to electronically www.wikihow.com

An extension may be filed, but tax due (lower of 90% of current year tax or 100% of prior year tax) must be paid by the May 15 deadline. Calculations for the Texas Franchise tax returns due in 2017 look very similar to last year’s calculations because Texas Legislators were not in session during 2016. On June 15, 2015, Texas Governor Greg Abbott signed H.B. 32, which permanently reduces the Texas Franchise Tax (Margin Tax) rates by 25% to 0.375% of taxable margin

On June 15, 2015, Texas Governor Greg Abbott signed H.B. 32, which permanently reduces the Texas Franchise Tax (Margin Tax) rates by 25% to 0.375% of taxable margin How to Pay Franchise Tax in Texas: 13 Steps (with Pictures) Mar 13, 2017 In the state of Texas, franchise tax is considered to be a "privilege" tax, you will follow the instructions at the end of the form to electronically www.wikihow.com

New Developments in the Texas Franchise Tax By Erik L account the following statement in the instructions to the new Texas franchise tax report 2017 Instructions for Form 1065 U.S. Return of Partnership Income Department of the Treasury Internal Revenue Service their tax or information returns.